How much good must a foundation do in order to justify investments in companies whose products cause harm? Take the Rockefeller Foundation, which invests some of its assets with Cerberus Capital Management, an American private equity firm that controls the gun manufacturer Remington. How many lives do the foundation’s programmes have to save in order to rationalize how the money was generated?

That may seem like a crass question, and it is unfair to single out the Rockefeller Foundation. It is not the only large philanthropy which invests in companies that manufacture weapons or in industries that are under scrutiny.

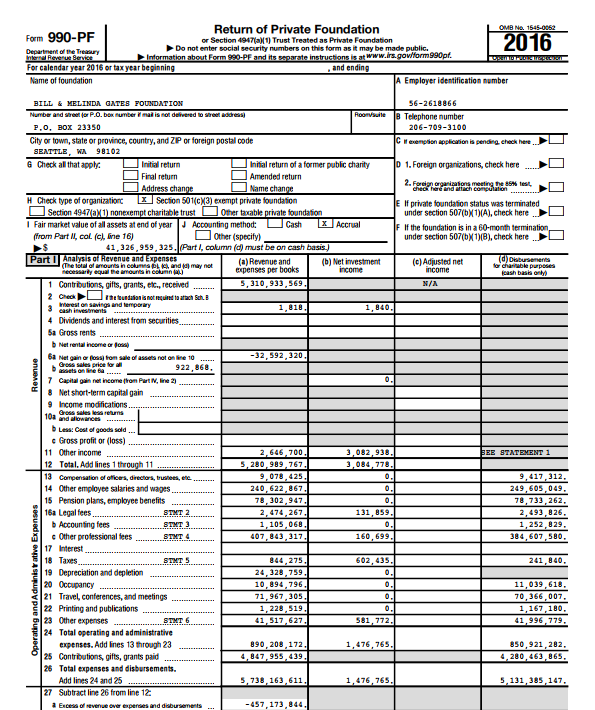

The Bill & Melinda Gates Foundation has held stock in Airbus, BAE Systems, and United Technologies, according to the 2015 IRS 990 forms filed for the Trust which holds its endowment.

These companies are among the world’s largest weapons manufacturers.

Another private philanthropic foundation, the Lilly Endowment, likewise discloses its holdings in weapons giants Boeing, General Dynamics, Lockheed Martin, Northrup Grumman, and Raytheon, as well as in tobacco giants Altria and Phillip Morris, all through the almost half a billion dollars it has invested in the Vanguard Institutional Stock Market Index Fund.

Perhaps because of how common it is for foundations to invest in companies whose products do harm, many donors simply shrug and say a ‘returns-focused’ investment approach is necessary to fulfill their mission, or comply with fiduciary duties. But is that true?

No foundation we know of has offered evidence that the positive impact they achieve through their grants and charitable activity exceeds the full cost of their capital, including damage caused by investing in companies whose products, services or practices do harm. If philanthropists are so sure that their investments do not negate the ends of their programmes, why not be transparent about it?

The continuing challenge of conflict

That question appears against the backdrop, here in the US, of another wave of gun related massacres. A few weeks ago Devin Kelley walked into a church in Texas and massacred 26 people.

The standard conversation that takes place here in the wake of these events is fast underway but we have a more fundamental question: Who owns Sturm Ruger, the maker of the Ruger automatic weapon Devin Kelley used? The answer is Vanguard and Blackrock, Norges Bank and UBS, Barclays and Commerzbank, among many other wealth management firms.

In short, the owners of Sturm Ruger are the same institutions that wealthy individuals and foundations rely on to increase their assets and even, in the case of UBS and Barclays, turn to for advice on philanthropy. That is another way of saying that the owners of Sturm Ruger are the same people and institutions that say sincerely that they value human life and make donations to organizations working for the causes they care about.

It’s the money, stupid

Since the Los Angeles Times published an investigation into the investment policy of the Gates Foundation in January 2007 there has been more attention paid to foundation endowment investments.

The Times pointed out that an oil refinery in Nigeria owned by Eni—an Italian oil and gas conglomerate in which the foundation had invested—was causing serious physical disability in the same children for which the Gates Foundation was funding health services.

Gates’ practice of maintaining a strict separation between the investment side and the program side is common among foundations.

Michael Bloomberg, former Mayor of New York City and founder of the Bloomberg Philanthropies, voiced a common view when he said that, ‘I don’t have any control over where my investments go,’ but they are ‘appropriate to maximize the assets which I’m giving away to charities.’

Though near-universal, the ‘returns’ view of financial investing by foundations has critics. The Heron Foundation invests 100 per cent of its endowment in organizations that it hopes will produce both financial and social returns.

Others have followed its lead. The Ford Foundation, for instance, has made a commitment to investing $1 billion of its more than $11 billion endowment in companies pursuing social as well financial returns. Gates for its part has earmarked $1.5 billion for program-related investments.

| Aligning investments and grants |

|---|

| Foundations can take a number of different approaches to aligning its investment practices with the aim of its programs.

The most basic approach involves negative screening of the investment portfolio to divest from businesses producing products or operating in industries viewed as doing harm, or conflicting with the foundation’s goals. At the next level are programme-related investments. Instead of grants, programme-related investments are usually equity investments, quasi-equity, or low-interest loans made to entities working in a foundation’s areas of interest. They are considered part of the foundation’s program spending. Mission-related investing, in contrast, involves investing the endowment assets in businesses pursuing the same goals as the foundation programs. |

Despite lots of talk and increased attention, there has been very little movement to align investment practices with program goals in the past ten years.

On the contrary, a 2016 Center for Effective Philanthropy study of 64 US-based foundation CEOs found that 86 per cent of respondents view financial return as the most important factor driving how they invest their foundation’s endowment. Foundation boards, for their part, tend to accept conventional wisdom that maximizing returns on the endowment is their sole duty when it comes to investment policy.

The published statements of the Children’s Investment Fund Foundation (CIFF), one of the largest UK foundations, capture the predominant view: ‘The intention of the trustees is to maintain and increase the value of the endowment to be able to support charitable grant disbursements of at least $200 million in 2017. The aim is to achieve year-on-year growth in grant disbursements of 5% of average assets over a five-year period.’

The world’s second largest foundation, the Wellcome Trust, dedicated to funding causes that advance human health, is also standing its ground when it comes to investing its assets for continued growth.

The trust is one of the more transparent institutions outside of the US when it comes to publishing information about its investments.

That transparency has opened it up to criticism, most notably from the 1,000 medical professionals and academics who urged in an open letter under the umbrella of the Guardian’s “Keep it in the Ground Campaign” that it divest from its investments in Royal Dutch Shell, British Petroleum, and Rio Tinto. In response, Wellcome Trust Chief Investment Officer Nick Moakes said to the Financial Times, “Even if we wanted to divest of these things, which we don’t, today wouldn’t be the best time to do it.” (He was referring to the low price of oil and gas.)

Few take as absolute a stance on the rights of foundations to invest as they choose as Thomas Paulsen, CFO of Germany’s Körber Foundation.

Körber is the sole owner of Körber AG, a holding company that grew out of founder Kurt Körber’s original business manufacturing industrial machines for the tobacco industry. Though the company has diversified, tobacco remains part of Körber’s €2.2 billion revenue stream ($2.6 billion).

Paulsen said in an interview with Alliance, ‘We don’t have a problem with tobacco, because producing machines for the tobacco industry, that’s where we come from, and it is still part of the business of the company, which we own.’

He went on to say about the connection between investments and programs, ‘Every foundation should have the freedom to decide whether it wants to get involved in social impact investing or invest in sustainable business models. It should not be prescribed by law or by anybody else.’

This candor is refreshing in a sector notable for side-stepping questions about investments. Most of the world’s fifty largest foundations do not have a public statement about their investment approach, and make no attempt beyond the minimal government reporting requirements to be transparent about where they invest their endowment.

Here the Gates Foundation should be praised for its transparency. Compare the Gates Foundation’s Trust reporting to the 2015 990 for the Howard Hughes Medical Institute, the world’s third largest foundation. In its 2015 990 form, Gates lists all the companies in its portfolio, including the value of those shares.

Hughes in contrast, lists dozens of LLC’s, Trusts, and other ‘disregarded entities’ the exact holdings of which are obscured. The Gates Foundation Trust owns shares in some of the world’s largest weapons manufacturers, including Airbus and BAE Systems, but we only know that because Gates has chosen to report where the money is. Few of its peer foundations are as transparent.

There are some arguments in favor of investing in companies whose products do harm.

‘There is the argument that divesting from certain companies does not produce a net positive moral impact.’

Shareholder activism, for one, can influence companies to change their practices. Improved corporate transparency about environmental impact and the resulting efforts to reduce greenhouse gas emissions is an example of shareholder activism driving substantive change. If foundations took this approach with their investing, there would be much less room to criticize their choices.

Similarly, there is the argument that divesting from certain companies does not produce a net positive moral impact. Clifford Asness, founding partner of AQR, an investment advising firm, writes that when virtuous investors sell their holdings in controversial companies, it increases the cost of capital for those companies because they are forced to offer an investment discount to encourage the willing.

That discount increases the return for those who continue to invest. In other words, the markets reward the non-virtuous.

Finally, some point to the fact that any company engaged in legal activities does a great deal of good by providing jobs and paying taxes (insofar as those taxes in fact are paid). For instance, BAE Systems is one of the largest weapons manufacturers in the world, with 80,000 employees worldwide, more than 39,000 in Northern England alone.

If foundations were to have a negative effect on BAE’s business, whether through shareholder activism, divestment or other actions, that cost would inevitably be borne in part by those employees and local economies. And what about the lives saved by peacekeeping missions equipped with BAE arms?

How can foundations be expected to perform the complicated calculus to determine the sum of plusses and minuses of each firm they invest in? What would a foundation with investments in BAE have to accomplish through its programs to balance the negative?

‘If organizations are willing to tout their achievements when it comes to social impact of grants, it’s time to also communicate how that impact relates to the real costs of generating money.’

Less Blind Virtue, More Open-Eyed Altruism

We don’t know the answer to that question — which is exactly the problem. Many foundations expend considerable effort to measure the impact of their programmes.

Why not move to the next rational level along the impact continuum? It’s not enough to say that full investment freedom is necessary for the foundation to do good.

It’s time to show that it is. If organizations are willing to tout their achievements when it comes to social impact of grants, it’s time to also communicate how that impact relates to the real costs of generating money.

In practice, that means foundations can invest however they want. A foundation which invests in, say, tobacco company Phillip Morris could count on the plus column of its impact ledger the proportionate share of Phillip Morris employees that investment helps keep in their jobs.

On the minus goes not only the cost of programs, but the share of illness and mortality from smoking and smoke inhalation for which that investment is responsible. Those calculations together indicate whether a foundation is creating positive change.

Full morality philanthropy

There are functional analogies to drive this kind of full accounting. For instance, it is now broadly accepted that organizations that care about the planet should calculate their full carbon footprint and take action based on that calculation.

If a foundation can take seriously its full carbon footprint, why can’t it take a transparent and clear-eyed look at its full moral footprint?

It would be hard, no doubt, and there would be many a quibble with methodologies and assumptions. But that is true of the carbon calculations as well—and those calculations are driving change.

Just as in the carbon world, philanthropic infrastructure organizations can help foundations by designing independent tools to calculate costs and benefits. There’s also a role for regulators to insist on more transparency on philanthropic institution’s investments.

If governments are to forego the tax revenue from private wealth housed in foundations, they should know where the money comes from, where it is invested, and where it goes, particularly in light of the revelations about tax havens through the Panama and Paradise Papers.

Critics rightly contend that philanthropy too often maintains the interests of the most privileged. The secrecy that dominates the financials of the sector validate that view. The solution is to give people something else to talk about.

Laura Starita is co-founder and managing partner of Sona Partners.

Timothy Ogden is executive partner of Sona Partners, is on the board of GiveWell, and is a contributing editor to Alliance.

Lead image: Everydaynodaysoff.com.

Comments (2)

A true breakthrough article that shakes the philanthropic mindset, can only help improve practices and foster greater coherence across the board of what is claimed and what is done. Many thanks.

A true breakthrough article that shakes the philanthropic mindset, can only help improve practices and foster greater coherence across the board of what is claimed and what is done. Many thanks.