It’s widely accepted that institutional philanthropy can achieve more by throwing the whole of its weight behind its mission. This special feature examines some of the ways and means in which foundations are doing so

Globally, the latest statistics suggest that philanthropy donates around $58 billion per annum and copious studies outline the many causes and issues we give to. In contrast, according to Paula Johnson’s estimate in her 2018 Global Philanthropy Report, our assets are estimated to be about $1.5 trillion, but unlike our grants programmes, there is relatively little information about what is clearly the largest element of our sector’s resources; they remain opaque, even to us.

Yet, these hidden assets – buried deep in capital markets – are arguably some of our most powerful tools for combating injustice, environmental degradation, poverty or any of the myriad issues which concern us. Indeed, I have called them our ‘superpower’: as endowed foundations, we have deep knowledge of the many challenges facing our societies and our countries as well as being important economic actors, controlling billions invested in capital markets all over the globe. Yet many of us ignore this power, focusing our attention only on the 5 per cent or less of our assets visibly at work. What we hope to do in this special issue is bring the other 95 per cent of foundation assets out of the shadows and into the spotlight. We also hope to show that all over the world trusts and foundations are actively using their investible assets to have definite impacts on the world.

EdenTree Investment Management presents to the ESG Olympics.

The shape of money

As funders, we are used to designing and implementing grant programmes to deliver certain outcomes. The skills involved in making this support timely and effective are essentially shaping money to most effectively address the issues.

Mission or high-impact social investing is a further journey down this path, as many funders have found that grant money wasn’t quite the right ‘shape’ to provide what was needed. High impact investment may underpin interventions through equity, it can provide early stage loan finance to build track records in revenue generating solutions, or use guarantees to de-risk new social ventures with the potential to scale.

The pandemic is both a tragedy for many communities and a shock galvanising new thinking and approaches in our sector, which can – it must be admitted – move at a geologically slow pace of change

This is undoubtedly a powerful additional tool for philanthropy but while it is an excellent way to create exemplars, scale great interventions and underpin the strength of key sectors, it is not a tool to effect macro-level structural change. For this, we need to engage capital markets and our investor power. By using our role as investors we can ensure thousands of workers are paid a living wage by supermarkets; we can put pressure on corporations to commit to tax transparency, decarbonising their supply chains and gender-equal boards and workplaces. In addition, through our relationships with some of the biggest investment managers in the world, we affect broader investment practices by providing important market signals and raising awareness within investment houses of areas of investment risk and client concerns.

This is undoubtedly a powerful additional tool for philanthropy but while it is an excellent way to create exemplars, scale great interventions and underpin the strength of key sectors, it is not a tool to effect macro-level structural change. For this, we need to engage capital markets and our investor power. By using our role as investors we can ensure thousands of workers are paid a living wage by supermarkets; we can put pressure on corporations to commit to tax transparency, decarbonising their supply chains and gender-equal boards and workplaces. In addition, through our relationships with some of the biggest investment managers in the world, we affect broader investment practices by providing important market signals and raising awareness within investment houses of areas of investment risk and client concerns.

Understanding models of business

This is deep work, requiring us to understand the corporate behaviour that may be at the heart of some of the biggest challenges facing our planet. The discussion with Larry Kramer and Ana Marshall of the Hewlett Foundation that forms the centrepiece of this issue is an exploration of how one foundation deeply engages with its investment managers to understand and address major challenges as peers as well as clients. A central insight is that by understanding business models and engaging with the industry, we build effective relationships which are at the centre of effective stewardship.

Mauro Meggiolaro from one of the Italian banking foundations outlines how foundations across Europe are collaborating to share expertise and resources to make investment a tool for change alongside other methods used by activists such as boycotts, demonstrations and the exercise of consumer choice.

Andrew Milner touches on the huge potential of gender lens investing in terms of both effecting corporate change as well as improving investment performance by grounding the idea of diversity of thought. This is also emerging as an important debate in the wake of Black Lives Matter – do we know who actually invests our money? Anecdotally, teams may be more diverse than we know; however, by not asking, foundations are reinforcing the view that clients feel less comfortable with investment managers who are female or people of colour. By showing we feel these are quality criteria, not risk factors, we may improve transparency and equity.

The crucible of coronavirus

In the forefront of current concerns, the pandemic is both a tragedy for many communities and a shock galvanising new thinking and approaches in our sector, which can – it must be admitted – move at a geologically slow pace of change. We can see that clearly in Latin America, where Maria-Laura Rojas of Transforma reports that searching questions are beginning to be asked of foundations’ investment practices as well as of corporate behaviours.

Although we have different missions as foundations, we share a commitment to responsible investing and a belief that managers should be responsive to our need for mission alignment, as well as returns

In the US, the mounting infection rate, the differential and deprivation-linked disease patterns and lack of coordinated response is leading a number of large foundations to take radical action. In addition to Ford Foundation’s recent announcement of borrowing funds against its considerable investment assets to give more immediately, it is also amongst a number of philanthropists proposing that the 5 per cent foundation payout rates in the US be doubled to 10 per cent. Is this too crude an approach to deal with the multiplicity of missions and responses of a diverse foundation sector or a necessary spur to action? The debate has yet to resolve.

Professor Nick Robins of the London School of Economics provides a powerful case for how Covid-19 will test commitments by both philanthropic investors as well as financial institutions to a just energy transition that balances both the needs of workers and the need for urgent action to stay within environmental limits.

Foundations as channels for funds for good

From the innovative work of Natasha Scully of the Australian Social Investment Trust (ASIT) we learn that it is not just what you do but also the authenticity and groundedness of the work that is undertaken. ASIT has developed a pooled investment vehicle which – although more about pooling funds for deployment directly in community focused programmes – addresses some of the limitations of impact investing by drawing partners including government into long-term engagement to address structural inequalities. This is both an opportunity and a challenge, requiring new thinking.

In China, we hear from Qing Gu of the Ford Foundation in Beijing that, although limited at present, the finance sector is increasingly seeing the burgeoning philanthropic sector as an effective vehicle for channelling funds to social enterprises.

Again, it is our ability to shape money to solve problems as well as deep grounding in the issues that is required.

Our kryptonite?

As we can see from the contributions from around the world, although we have great power and potential in the use of investment assets in support of our missions, we are also dependent on those that advise us, those that manage our funds and engage with companies on our behalf. In South Africa we can see that the lack of engagement of investment advisers is an important limiting factor; this was certainly the issue in the UK for a number of years. Indeed, ignorance, lack of previous practice and ignorance of viable alternatives are significant limitations we have all faced.

Panel discussion at the 2019 ERIN conference on engaging with high carbon companies.

A solution that we can see being used repeatedly is collaboration – coming together to challenge and push the boundaries to demand more imagination and better investment approaches to meet the need we know is there. Lily Tomson of ShareAction expands the theme of collaboration as a key strategy for exercising our superpowers. Through the creation of the Charities Responsible Investment Network, European foundations have found a way to speed up learning about investment developments, new thinking and practical actions – shareholder activism and engagement – to make the most of our strengths and abilities.

In the UK, the Association of Charitable Foundations’ ‘stronger foundations’ working group has explored how investments can be brought into our strategic arsenal to be of true service to our missions and has published principles of best practice in this area.

If we as organisations working to make the world a better place do not consider how we use our assets to do so, we will miss the opportunity to make an impact on the huge global challenges confronting us

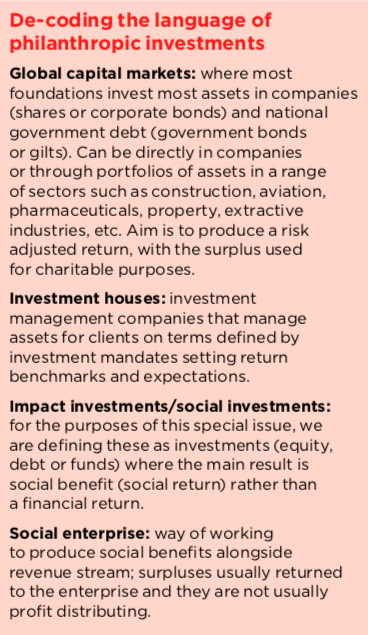

My own trust, Friends Provident Foundation, undertook an exercise in what we call ‘radical transparency’ to bring investment practice out of the shadows and involve a wide range of expertise – academics, NGOs, beneficiary groups, trustees and peers – in the process of selecting a manager. We collaborated with two other medium-sized foundations to hold the first ESG investing Olympics – with an open call to the investment industry to pitch to us their best ideas for managing assets of £30 million in line with our shared investment policy. Although we have different missions as foundations, we share a commitment to responsible investing and a belief that managers should be responsive to our need for mission alignment, as well as returns. Our Investment Engagement manager, Colin Baines outlines the process and we hope it will inspire others to demand more of those we work with to manage our money.

As mission-driven organisations with deep roots in people, places and issues we have a responsibility to make active decisions about the use of the majority of our resources. High-profile mission-led organisations such as The Bill and Melinda Gates Foundation in the US, Comic Relief and the Church of England in the UK have experienced public scandals relating to their investment holdings. Our money is out there expressing who we are and we need to know what it is saying. From the investor side, the growth and development of the expectations of transparency and disclosure are growing globally for public and private investors alike; ensuring our houses are in order is becoming a presumption of investment competence and fiduciary duties. And perhaps most importantly, if we as organisations working to make the world a better place do not consider how we use our assets to do so, we will miss the opportunity to make an impact on the huge global challenges confronting us – and it’s one we can’t afford to miss.

I have found the contributors in this special issue incredibly inspiring both in terms of what has been achieved and what more there is to be done. It is exciting to see that for us to truly recognise our powerful capacity which rests on having one foot in the challenges that are facing global society and the other in capital markets and investments, we must find new ways of collaborating and moving forward.

Danielle Walker Palmour is director of the Friends Provident Foundation.

Email: danielle.walker@friendsprovidentfoundation.org.uk

Twitter @DaniellePalmour

Comments (0)