In the UK, the largest 300 endowed charitable foundations have over £72 billion in total assets. Yet, despite the field of impact investing originating from within the foundation community, the vast majority of these assets are invested in mainstream capital markets without consideration of their environmental and social impact.

A few pioneers have sought to challenge this norm. In the UK, Access – the Foundation for Social Investment, Esmée Fairbairn Foundation, Friends Provident Foundation, Guy’s & St Thomas’ Foundation, Treebeard Trust, and Ufi VocTech Trust are notable examples; in the US, FB Heron, and the KL Felicitas Foundation are leaders in their field. There have also been high-quality interventions from key bodies, with the Association of Charitable Foundations, ShareAction, and EIRIS, in particular, creating helpful resources for charities.

Despite these efforts, however, impact investing has not cemented a strong foothold in a field which may, from the outside, seem ideally suited to it.

At the Impact Investing Institute, we believe that the time is ripe for change. The myriad issues the world faces – from climate change and biodiversity degradation to Covid-19 and the cost of living crisis – have driven home the need for a massive increase in investment to help address environmental and social problems.

At the same time, the impact investing market itself is reaching maturity: our market sizing project earlier this year found the UK market alone to be worth £58 billion, with a further £53 billion of impact-aligned investments, and examples abound of investments that can deliver market-competitive returns alongside positive social and environmental impact.

Why endowments should be enthused to deliver an impact investing approach

We believe there are five central arguments for why it is valuable for foundations to pursue impact investing in their endowments. Firstly, and perhaps most importantly, it increases the volume of assets seeking to deliver mission and public benefit outcomes. By unlocking the endowment, the foundation’s ‘super power’[1], and investing a proportion in carefully chosen impact investments, far greater impact can be achieved than through grantmaking alone. Financial return on these investments only compounds this additional benefit, as the same quantum of money can be recycled.

Moreover, the power of investment is not just limited to the funds it adds; it can also enable new strategies to effect changes that are not possible through grant-making.

Say, for instance, you are a foundation targeting climate change mitigation. Although grants to non-profit organisations are valuable, much of the work that needs to be done is in the private sector. Through targeted private sector investment, foundations can champion innovative, sustainable businesses that will lead the way to a net-zero future while still generating a financial return. As Danielle Walker Palmour, CEO of Friends Provident Foundation, put it: ‘Not every problem is grant shaped.’

Deploying a financial lens, as foundations generally have a long-term time horizon, they increasingly must grapple with the systemic risks posed by factors such as climate change and social inequality.

Such investment would not just affect the foundation’s mission – it can also catalyse change in other investors and in the capital markets more broadly. By demonstrating that foundations can engage in positive impact investment whilst delivering on their commercial goals, foundations can inspire others to help drive a broader capital markets transition. This would also have a significant impact on the financial services industry itself – if, for example, five per cent more endowment assets, or £3.6 billion, were allocated to impact in the UK by charities, this increase would incentivise industry practitioners to better deliver for their client base.

Not all the arguments for investment in impact are external – there are also significant ‘pull’ factors too. With awareness of the severity of the social and environmental crises we face becoming increasingly widespread, there is a perception gap for the average citizen between what they would assume the majority of a foundation’s assets are delivering, and the reality of them being invested without impact considerations. For foundations or endowed bodies like universities, there can be reputational risks from not contributing to environmental and social goals. The clarion call for foundations to consider the impact of their investments has only become louder – adopting an impact perspective can be a vital defence against reputational damage.

Deploying a financial lens, as foundations generally have a long-term time horizon, they increasingly must grapple with the systemic risks posed by factors such as climate change and social inequality. These risks are not abstract – there is well-documented evidence that social and environmental issues can have adverse financial impacts. Delivering an impact investment approach in the endowment will help foundations to better understand these risks and crucially, gets investment managers on the front foot: spotting negative social and environmental issues before they arise and making sure they are on the right side of regulatory development.

While the arguments for foundations adopting an impact investing approach still need to be made, awareness is spreading – indeed, this very publication released a powerful special feature on foundation investments in their September 2020 issue.

Despite this awareness, knowledge gaps remain. So, as part of our practical guide for foundation leaders, ‘Investing for impact in the endowment: Why do it and how to get started’, we set out five concrete steps endowments can take, supported and demonstrated by examples of the sector’s pioneers.

Five practical steps to becoming an impact investing endowment

1. Obtain an internal mandate for impact investing

Interest in the impact investing agenda in any given foundation may spring from a variety of places: from the CEO or professional staff to a trustee curious about whether the foundation could do more. But, for the approach to be taken up by the foundation more broadly, the consensus of a wider group of stakeholders is required. This can be achieved through an exercise of information sharing, education, and consultation.

Esmée Fairbairn Foundation provides an illustrative example. At the start of its journey towards impact, decisions were entirely delegated to its investment committee, with its investment advisers having never presented to the full board. Work was needed to take trustees to a place where they were well informed and comfortable with the risks and opportunities associated with impact.

For example, the foundation asked its adviser, Cambridge Associates, to speak to each of its trustees individually, presenting views on climate risk and the need to incorporate these risks into the foundation’s long-term investment strategy. This led to the Esmée Fairbairn Foundation Net Zero strategy.

2. Establish financial and impact requirements for the endowment

Once a mandate has been achieved, it is important to make clear the financial and impact requirements under consideration.

There are many different ways to do this. Credit Suisse shared a specific roadmap with us that it uses:

- Step 1: Set a financial goal tied to the foundation’s cashflow needs: What are the financial needs the foundation has, and how does the endowment need to serve them?

- Step 2: Determine the foundation’s liquidity needs: Delivering an impact investing approach is strengthened by being open to private markets opportunities but most endowments default to a liquid portfolio out of norm. To counter this, foundations can flip this onus, being comfortable that anything that doesn’t explicitly need to be liquid can be invested in illiquid assets.

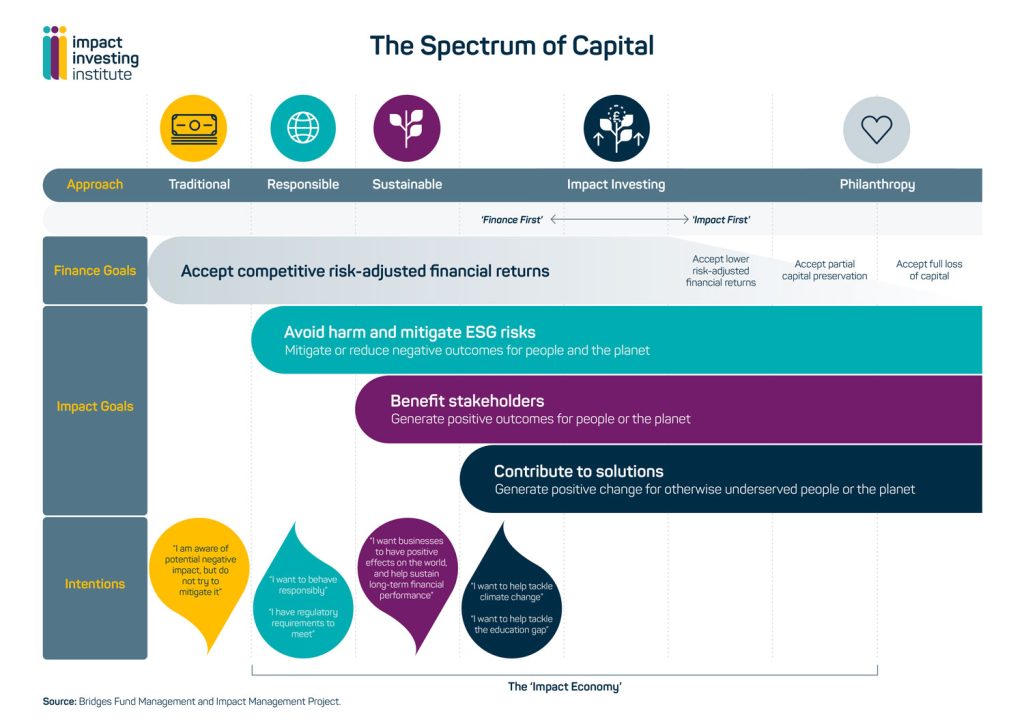

- Step 3: Allocate to the spectrum of capital: Once these steps have been completed, Credit Suisse creates a tiered allocation approach ranging from impact investing (Tier 5) and flowing back through to traditional investment (Tier 1) broadly in-step with the Spectrum of Capital[2]. Credit Suisse aims to target as much of the portfolio as possible in tier 5.

Once financial goals have been conceptualised, focus can return to mission. The impact investing market is growing year by year and so, contingent on the breadth of the foundation’s mission, there will likely be some impact approach or product that is suitable – although, as with any investment strategy, the more restrictions placed on managers, the harder it will be to find mission-aligned investments. Similarly, there are enough impact investment products available to diversify a portfolio – but if the foundation is too strict on theme, with the current exception of climate change, the selection is likely to be too small.

Because of this, thematic mission-aligned preferences can be included where available and possible, and thereafter the creation of a more generalised public benefit can be a helpful way of thinking about the impacts created. If the choice is between mission alignment and no impact investments, or public benefit alignment and some impact investments, the latter clearly generates more positive ‘net-impact’ overall.

If in need of guidance when selecting goals, common frameworks such as the UN SDGs can be a helpful communication bridge between the investment and foundation worlds.

3. Update the Investment Policy Statement

The Investment Policy Statement is a key document communicating the foundation’s parameters on investment performance. The foundation should revisit and update its IPS to enable an impact investing approach. If the IPS is not changed by a foundation interested in impact investing, creating an impact allocation can be an uphill battle, chafing against the mandate the foundation is issuing to its investment advisers and managers.

4. Integrate impact and investment at board and staff level to deliver the strategy

Despite the foundation as a whole being a combination of both finance and impact, endowment management and grants management are often managed as if they were two separate entities. To deliver an impact investing strategy, these two worlds need to be brought together. At the board level, this may involve diversifying the investment professionals on the investment committee to include impact specialists. At a team level, new personnel may be required beyond the financial director – in all of the foundation pioneers we produced case studies on, from Treebeard Trust at £20 million to Esmée Fairbairn Foundation at over £1 billion, there was a key individual hired to challenge, provoke and oversee the impact side of the investment strategy.

This is not a necessity, however; for those who are resource-constrained, a good investment manager, adept at impact and with strong client ethos, can be sufficient to support the strategy.

5. Appoint investment advisors, managers, and asset managers with expertise in impact

A strong working relationship between a foundation and the constellation of financial professionals managing the money is essential for an impact investing strategy to succeed. If a foundation finds itself with a manager who doesn’t understand the field, they are likely presented with one course of action: run a selection process to obtain new management.

Presented with the need to find a new impact manager, Friends Provident Foundation developed an ingenious solution: the ‘ESG Investing Olympics’. Joining together with Joffre trust and Blagrave Trust, they launched an open, competitive tender for a £33 million mandate, resulting in 60 proposals with collective AUM of £15 trillion. A shortlist of five managers presented at the Royal Institution in March 2020 to an audience of 150 investors and grantees. Not only did this lead Friends Provident to their new impact manager, it also helped to share emerging best practice on impact and ESG with other foundations.

The future for foundations

In May of this year, Guy’s and St Thomas’ Foundation announced they would be increasing their impact allocation from £22 to £100 million by 2026 – the largest known impact investment allocation in the UK by a foundation.

Led by such pioneers, a community of practice of impact investing endowments is emerging. Through our Endowments with Impact programme, and our publication of resources, case studies, a legal paper and a downloadable presentation to facilitate board-level discussion, we hope to support and nurture this growing community.

Above all, we hope to help more foundations unlock the engine of their endowment to deliver the environmental and social outcomes that matter to us all.

Sarah Teacher is the Executive Director of the Impact Investing Institute and oversees the Endowments with Impact programme.

For more information on the Endowments with Impact programme, or to see how the Impact Investing Institute may be able to assist with the development of your impact investing approach, get in touch via sarah.teacher@impactinvest.org.uk.

Comments (1)

It is surprising that so many foundations don’t consider social and environmental impact with their investments. I can remember the Association of Charitable Foundation's Intentional Investing report from 2015 and thinking that should spark more action. Perhaps it did, but not enough. In the past, trustees were often turned off by the notion that financial returns might be sacrificed in pursuit of ethical goals. However, that argument doesn’t hold anymore. ESG funds have performed well over the past 10 years. Companies that positively manage ESG issues are less exposed to ESG incidents that damage performance and profitability. Companies exposed to high environmental, social and governance (ESG) risks will increasingly underperform the market. I work for The Charity Service, which runs a small number of Donor Advised Funds (DAFs). We are a niche DAF provider and we have always invested our funds ethically. All of our investments are made with an ESG lens. This is one of the reasons why donors choose us. Indeed, we are beginning to attract more donors precisely because of our ethical investment approach. Charitable assets held in DAFs in the UK are already thought to be over £2billion and with the market growing rapidly, the investment approach taken by DAFs will become ever more significant. Appointing advisers and managers with genuine expertise and commitment to impact investing is especially important. There are a lot of asset managers now piling into the ESG arena and not all of them have good credentials!