To meet the target set by the Paris Agreement, a radical shift in corporate behaviour is needed. Foundations can use their influence to drive this forward working with investment managers and engaging corporations.

While particular missions and approaches may be different, at their heart charitable trusts and foundations exist to deliver positive impact for society and the environment. Traditionally a key mechanism for achieving mission has been through grants – funding other charities to achieve a social impact through their work.

The role of mainstream investments has usually been straightforward for most foundations. The investments generate the income that we use to carry out our charitable activities, whether that’s through making grants or direct activities. Alongside this approach, many charitable investors take an ethical stance by not investing their money in industries or sectors that they perceive to be in conflict with their mission, or contributing to the problems they are trying to solve. For example, a health charity may avoid investments in tobacco companies.

In recent years, however, many trusts and foundations have looked at their overall approach and asked if there are further ways to fulfil their mission, such as responsible investment.

Engaging with investee companies

Responsible investment means the investor takes a position as an enlightened asset owner. As such they engage with investee companies, either directly or through investment managers, to encourage positive behaviour and policy and discourage action that has a negative impact on society and the environment. This approach enables the investor to mitigate the financial risks in their portfolio associated with environmental, governance and social factors, as well as producing the returns needed to pay grants and contribute directly to the mission.

‘Responsible investment means the investor takes a position as an enlightened asset owner.’

At Barrow Cadbury Trust, we believe that engaging with companies is part of being a good steward over our capital and investments, and we have identified other foundations that want to take a similar approach to investments.

‘We believe that climate change represents a huge risk to our mission, and to our investments, and think that engagement is needed to change companies’ behaviour from ‘business as usual’ to supporting a low-carbon transition.’

One of the areas on which Barrow Cadbury Trust has been engaging with companies is reducing their contribution to climate change. We believe that climate change represents a huge risk to our mission, and to our investments, and think that engagement is needed to change companies’ behaviour from ‘business as usual’ to supporting a low-carbon transition. Preventing catastrophic climate change will require a huge shift in corporate behaviour. If we are to limit temperature rises to a very maximum of 2°C, as agreed at COP21 in Paris last December, companies across the world will need to transform their business model to ensure that this limit lies at the heart of their business strategy. As owners of the stock of these companies, shareholders are uniquely placed to help make this change happen.

Engagement strategies

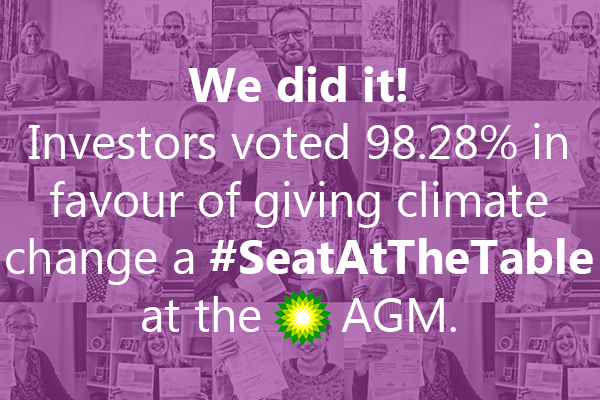

The power of responsible investment has long been exercised through engagement strategies. Such strategies include shareholder resolutions, asking questions at AGMs, and collaborative investor engagement. Robust engagement is becoming increasingly popular throughout the investment community. Barrow Cadbury Trust has engaged with investee companies in a variety of ways and seen significant success. For example, last year, along with many other charities, faith-based investors and mainstream asset owners, we supported the filing of the ‘Aiming for A’ resolutions at BP and Shell on climate risk and strategic resilience, encouraging greater disclosure regarding the risks of climate change on the companies’ business models. With the support of company management, these subsequently passed with the support of nearly 99 per cent of the companies’ investors.

‘Opportunities abound this AGM season for investors to use their weight to support climate action.’

We’ve worked closely with partner organizations such as ShareAction – a UK charity that campaigns for a responsible investment system – to understand the quality of company reporting. We’ve attended meetings with companies to ask their representatives directly about the risks climate change poses to the business and how they are managing them. This year we have also supported the ‘Aiming for A’ resolutions at several big mining companies, helping send a signal to company management that we want them to take action.

Opportunities abound this AGM season for investors to use their weight to support climate action. For example, a series of resolutions have been filed at US oil giants ExxonMobil and Chevron. These US firms are being pressed to disclose how resilient their portfolios and strategy would be under policy scenarios that restrict global warming to 2°C, and institutional investors with more than $6 trillion have already declared their support for this proposal at ExxonMobil.

Climate engagement isn’t – and indeed, shouldn’t be – restricted to fossil fuel companies. To create a 2°C economy, investors also need to consider how they can influence other sectors whose transformation will be vital if we are to curb emissions. These include the transport sector, utility companies, finance industry and livestock production, and we have also engaged with automobile companies about their carbon emissions.

‘We believe that collaborative engagement with companies by a number of shareholders can be particularly effective.’

Collaborative engagement

As well as taking this approach ourselves, we believe that collaborative engagement with companies by a number of shareholders can be particularly effective. Barrow Cadbury Trust works with like-minded investors through groups such as the Church Investors Group and the Charities Responsible Investment Network. Supported by ShareAction, the Charities RI Network enables its growing membership to learn from each other to develop their approach as Responsible Investors, to receive training and research on issues relating to our missions and investments, and to engage together with companies to achieve change, on issues ranging from living wages to renewable energy to overuse of antibiotics in our food supply.

Results?

Some investors question the impact of a responsible investment approach. However, engagement has been shown to be effective at influencing companies’ behaviour and benefiting both mission and returns. For example, a 2011 study which examined the effect of environmental shareholder resolutions on chemical and petroleum firms’ environmental performance found that these resolutions had a significant positive impact, reducing the amount of chemicals released into the environment. Another example is the campaign co-ordinated by ShareAction to get FTSE100 companies to pay wages at the accredited Living Wage Foundation rate. When that work began in 2011 only two of the FTSE100 companies paid this rate. Today, 30 FTSE100 companies are accredited.

At a system level, various studies show that companies with good environmental and social practices perform better financially. However, engagement is not the only strategy an investor can employ to tackle climate change. Many have championed divesting from fossil fuel companies and reinvesting money in energy sector alternatives. We welcome the publicity arising from the Divest-Invest campaign and will ourselves divest from companies where engagement proves fruitless. Both approaches are creating real pressure on fossil fuel companies, and are aiming at the same goal – a transition to a low-carbon economy and a world with a temperature rise of well below 2°C.

‘Corporate engagement is a long game, and instant results aren’t always possible – as is the case with a lot of grantmaking.’

Corporate engagement is a long game, and instant results aren’t always possible – as is the case with a lot of grantmaking. While the passing of the 2015 resolutions at BP and Shell, and other actions achieved through engagement, mark important steps forward, it is vital that investors monitor whether companies are committed to their pledges. If they are not, and if climate promises are not being kept, we must push forward a more ambitious agenda, and make sure our asset managers are on board too. Barrow Cadbury Trust will continue to work with our investee companies and asset managers to see our investments working harder towards our mission, and to drive forward the shift to a low-carbon world, and will do so in collaboration with numerous other investors with a similar aim. We’d be very pleased to talk to other foundations with the same aims.

Mark O’Kelly is head of finance and administration, Barrow Cadbury Trust. Email m.okelly@barrowcadbury.org.uk

Comments (0)