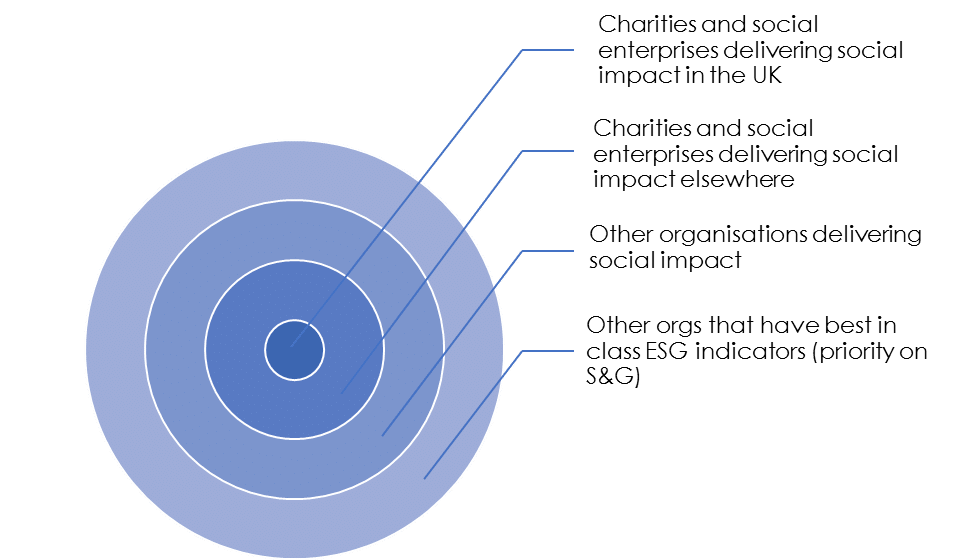

Foundations’ missions and investments won’t always be perfectly aligned, but the centre of the target is always worth aiming for

Whatever stage foundations have reached in aligning their investments with their mission, there are common barriers that hold them back. Access’s journey offers useful clues as to how to get past these barriers.

The bull’s-eye model enabled intent to be clearly communicated, progress to be monitored, and investments which didn’t perfectly align with the mission to be more aligned than otherwise.

Access – The Foundation for Social Investment, aims to make charities in England more financially self-reliant. Our £60 million spend-down endowment was provided to Access by the UK government in 2015. Following its establishment, an endowment working group was formed of three trustees with social investment and foundation experience, and two external members: one a specialist in impact management and one with mainstream investment market experience. Knowing that a 10-year spend-down endowment would have particular requirements, the group spent time understanding the interplay between liquidity, financial return and social impact goals before it started to develop a detailed model which became an investment policy. The conclusion: a fixed income focus, with bonds held to maturity, would provide clear cash flows and the best opportunity to seek impact.

This goes against the traditional model of governance. Investment and impact tend to be managed by separate groups trying to solve different problems: the former, how to maximise available cash, the latter how to deploy it in the best way. Having both in the room allowed for the complex interplay between the two and the exploration of necessary trade-offs.

Another barrier faced by foundations is a lack of obvious examples of which investments will provide both impact and financial return.

Foundation trustees should give a clear mandate to their asset managers about how they want it to be done. If their asset manager doesn’t want to deliver that mandate, find a new one.

Access’s endowment working group knew that the foundation’s financial constraints, in particular the 10-year time horizon, would limit the universe of possible investments. While we sought to align investment and mission as much as possible, it was unlikely to be perfect. The bull’s-eye model enabled intent to be clearly communicated, progress to be monitored, and investments which didn’t perfectly align with the mission to be more aligned than otherwise. The mandate for the investment managers is, within the financial requirements, to hit the bull’s-eye as much as possible, and only then move into the outer rings.

Image Credit: Access

Sector transparency is helping to overcome this barrier. Following the trend for more open grantmaking, expectations on foundations to share their approach and underlying portfolios will increase. For our part, we have published our investment policy, an impact report with full details of the portfolio and regular blogs about the ups and downs of our approach.

Sometimes too much faith is placed on asset managers reluctant to move out of their comfort zone. Foundation trustees need to recognise their responsibility for how funds are invested and should give a clear mandate to asset managers about how they want it to be done. If an asset manager doesn’t want to deliver that mandate, find a new one.

We were struck by how hard it was to find an asset manager in 2016 who wanted, and had a credible plan, to deliver our mandate. We partnered with Rathbones but were often told that what we wanted to achieve was not possible. Things have moved on since then but the main driver for change will be more foundations demanding an impact lens to their portfolio.

We are one of many foundations to make progress on this journey and we all have further to travel. Seeing the management of assets as a key part of the changes we bring about will become the norm and the barriers holding foundations back can be overcome with a clear sense of purpose and a desire to change.

Seb Elsworth is chief executive of Access – the Foundation for Social Investment.

Email: seb.elsworth@access-si.org.uk

Twitter: @si_access

Comments (0)