Institutional philanthropy is in a significant moment of change.

It is vitally important to think about the opportunities for foundations for strategies that go beyond carbon emissions.

In this event, we partnered with Mercer to examine the issues we face today, and how to invest your portfolio with impact and investments front and centre.

In this event, we partnered with Mercer to examine the issues we face today, and how to invest your portfolio with impact and investments front and centre.

Moderated by Sarah Teacher, Executive Director at the Impact Investing Institute, the speakers were:

- Ellen Dorsey, Executive Director, Wallace Global Fund and President, Divest-Invest Philanthropy

- Martin Rich, Chair of the Endowment Committee, Access – The Foundation for Social Investment

- Hill Gaston, UK Head of Sustainable Investment, Mercer

Here are some key takeaways from each panellist.

Ellen Dorsey

Climate change is not happening in a vacuum, it’s being driven by an economic system where corporations and financial institutions have disproportionate power exercise deeply over governments, weakening their capacity to respond to the crisis. As governments are less able to regulate, uphold the social contract, and pass policies fit for purpose, then finance becomes an even more important lever to use to hold corporations accountable or shape their activities. That is why the climate movement has made finance a central strategy

Climate change is not happening in a vacuum, it’s being driven by an economic system where corporations and financial institutions have disproportionate power exercise deeply over governments, weakening their capacity to respond to the crisis. As governments are less able to regulate, uphold the social contract, and pass policies fit for purpose, then finance becomes an even more important lever to use to hold corporations accountable or shape their activities. That is why the climate movement has made finance a central strategy- Philanthropy is not just any investment sector. We have a unique role as mission-driven investors with capacities and assets that can aid in developing and scaling solutions. Philanthropy receives charitable tax status to serve the public good, and our investments should not escape that test. We should not drive harm with our investments that we ask our grantees to solve with a fraction of those assets.

- We could set the bar high for every other investment sector with our own actions as examples. We could set a high target for investing in renewable energy and clean tech – say 15-20% of our investment portfolio. We could commit to be net zero, but we could go further and set a public goal that we will not invest in ANY new fossil fuels… they’re already stranded assets

- Seed and scale critical initiatives to advance a Just Transition. We have an opportunity to actually use our investment capital with incredible transformative potential to help aid Just Transition, to reach extractive workers and communities that are displaced… we can invest in Indigenous and BIPOC communities that have had disproportionate harm from extraction, from colonialism, and support their enterprises with grants and investment capital. We can align grants and impact investments, and we should set a goal that will set up fair returns for the projects. Let’s decolonise impact investing.

- We have an opportunity to shape that industry to be the least harmful they can be. Bank with banks that don’t do bad things – don’t loan to fossil fuels, don’t harm racial, gender and economic justice.

- We started our journey in 2009 – by 2012, we were 100% ESG integrated, 100% divested from fossil fuels, 23% invested in climate solutions, renewable energy and clean tech; we have 5% invested in high-impact investments where we prioritise working with communities who design projects and design their own desired impacts. We accept a fair or shared return. We then engage in extensive shareholder advocacy; this did not come in expense of returns. For the last decade, we have consistently outperformed our benchmarks, we are in the top 10% of foundations for the last decade.

Martin Rich

Access has some unique points. We were set up from an endowment from dormant assets here in the UK. It was a UK government initiative that created us as an organisation. We had a limited life of 10 years from where we were set up, and most importantly due to the vision both within government and also those who were involved in setting Access up on day one, we managed to get a concept of total impact embedded into the very articles of the foundation.

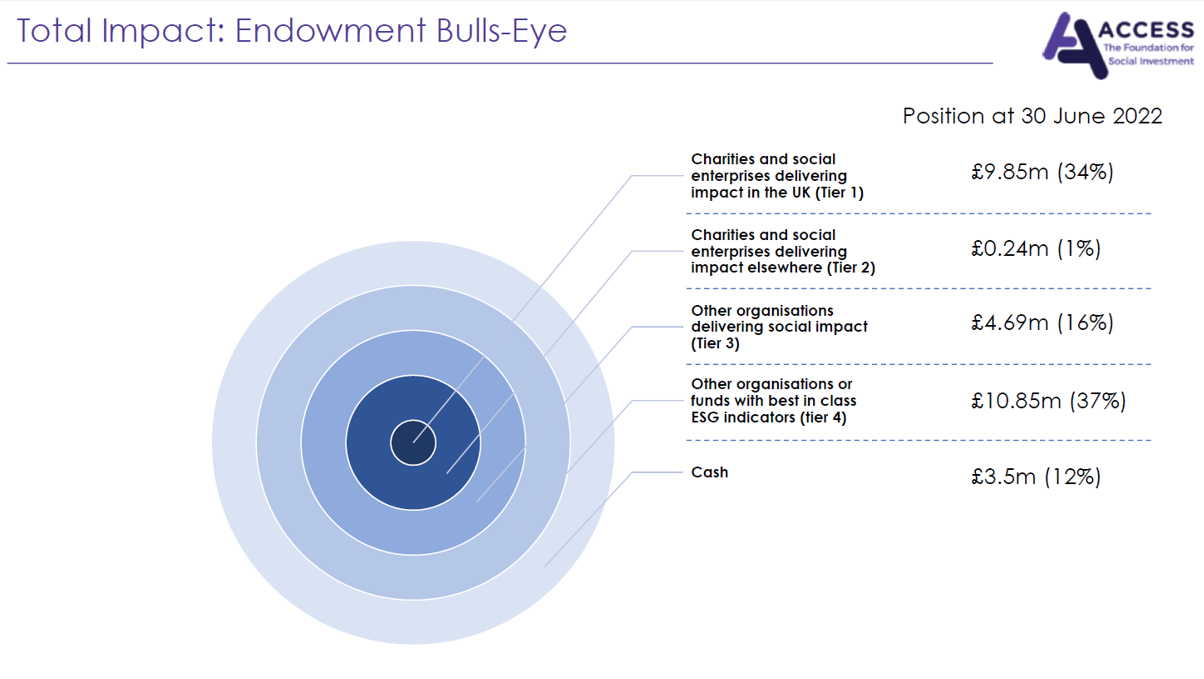

Access has some unique points. We were set up from an endowment from dormant assets here in the UK. It was a UK government initiative that created us as an organisation. We had a limited life of 10 years from where we were set up, and most importantly due to the vision both within government and also those who were involved in setting Access up on day one, we managed to get a concept of total impact embedded into the very articles of the foundation.- Access came up with a bullseye approach to define broad categories for where we wanted our capital to go

- We’ve absolutely blown the benchmarks we set ourselves out of the water. We’re a spenddown portfolio, so we limited ourselves in the end to debt, funds and cash; we didn’t have any equity investments because we had a spend profile that we wanted to stick to, so we wanted a maturity of assets that we could put into the programmes Access funds. Our total return has been about 10%

- When we set this portfolio up, it was with a very social focus. But more recently, we’ve wanted to embrace a move towards net zero. But guess what? Because of the way we’d set the portfolio up on day one, we weren’t having a massive environmental impact from the get-go. There were no oil companies, no coal mines to get rid of. By setting up the portfolio as 100% mission-aligned, we didn’t need to go through the difficult transition that so many others have had to.

- Number one advice would be to build your own internal team through the board and through independent, external advisors who will just come on board – there’s lots of pro bono folks who would be happy to roll up their sleeves and join you on your side of the table to help you create the right type of approach

Hill Gaston

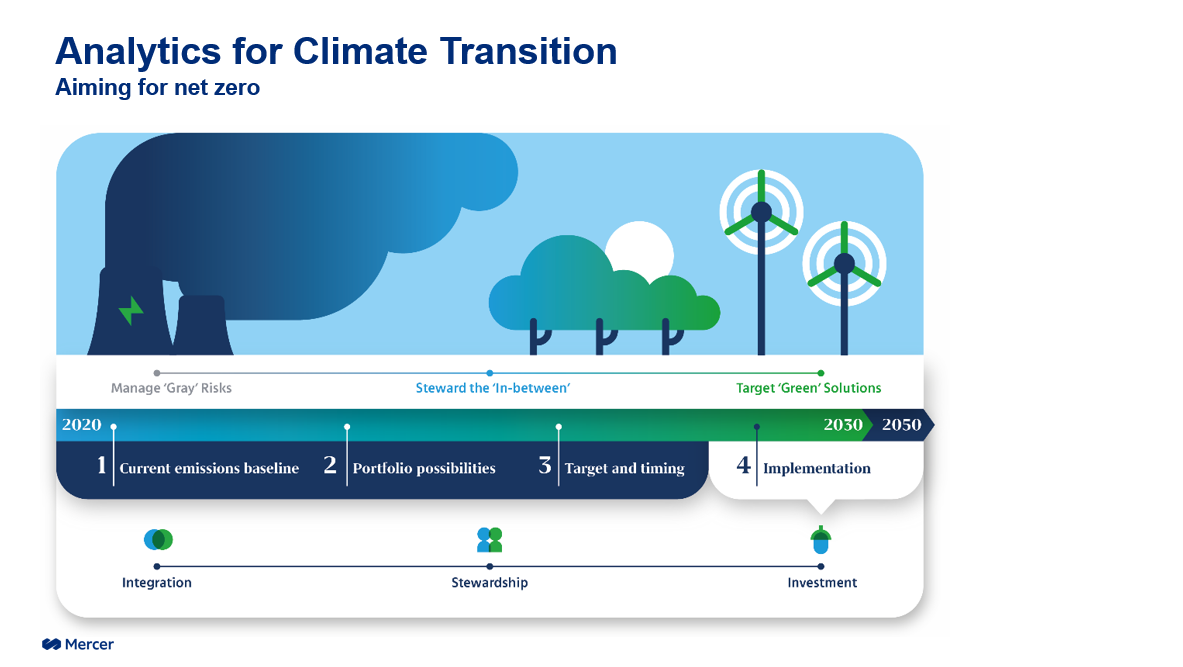

There are a lot of questions still for foundations and endowments and wider institutional investors around the practical implications. Investors, in order to align with a net zero target, they need to think about developing a climate transition plan. This needs to be a plan that defines clear targets and trajectories – it’s going to encompass not just your listed equities but the entire portfolio. Over time it’s one that needs to be long-term in nature, so ten years and beyond. But critically, it’s one that identifies what can and needs to be done today

There are a lot of questions still for foundations and endowments and wider institutional investors around the practical implications. Investors, in order to align with a net zero target, they need to think about developing a climate transition plan. This needs to be a plan that defines clear targets and trajectories – it’s going to encompass not just your listed equities but the entire portfolio. Over time it’s one that needs to be long-term in nature, so ten years and beyond. But critically, it’s one that identifies what can and needs to be done today- The Analytics for Climate Transition framework is looking to have confidence in answering a number of key questions. Investors need to interrogate and understand the potential downside risks they face as a result of a low carbon transition, as well as the opportunities to invest in the companies of the future.

- If you set these net zero emission reduction targets, can you still meet your investment objective? We’ve had a strong, resounding take on that from the panellists that that’s something we can do, but we need to think about that in an intelligent way.

- There are four steps:

- Looking at and understanding your baseline emissions: Understanding where you are today to plan for the future

- Portfolio possibilities: Understanding the transitional capacity of the portfolio you’re invested in

- Targets and timings: A way of annually assessing and making sure you’re on track

- Implementation: a credible, multi-year plan that can be integrated into the wider investment strategy and portfolio construction

You can watch the full recording of the event here:

Our next Alliance event is on philanthropic leadership, which will take place in October. Make sure you are on our mailing list in order to receive an invite!

Amy McGoldrick is the Marketing, Advertising, and Events Manager at Alliance.

Comments (0)