In this time of global crisis, foundations must lead with all of their capital. Foundation assets globally exceed $1.5 trillion. If foundations deployed their endowments into impact investments, they would accelerate solutions to COVID-19 and climate change much faster than they can with grantmaking alone.

Why aren’t more of them already doing this? Impact-leader foundations believe overcoming myths about impact investments’ financial performance is the top challenge on the path to fully aligning assets with a foundation’s mission.

Three of the top barriers are misconceptions around fiduciary duty, risk and foundation size, according to Toniic’s T100 Focus Report: Foundations on the Road to 100%. The report draws on data from 18 foundation portfolios, representing $1.7 billion in committed capital, in the Toniic network of impact investors. The report is the first in the T100 Project – Toniic’s ongoing study of investors building 100 per cent impact portfolios – to focus on foundations.

Fiduciary duty and mission alignment

Foundations differ from other types of impact investors because they must answer to charitable foundation trustees. Many are hesitant to start impact investing because they mistakenly believe that fiduciary duty prevents it.

‘Fiduciaries are less risk taking than individuals,’ said Stephanie Cohn Rupp, chief operating officer of Veris Wealth Partners, in the report. ‘Any investment criterion that is arguably unrelated to financial return is suspect in the fiduciary mind.’

Yet 38 per cent of T100 foundations have found that impact investments yield higher financial returns compared with traditional long-term investments, and 62 per cent see them yielding the same returns.

These leaders believe fiduciary duty compels mission alignment of endowment investments for two reasons: foundations should put advancing their mission on par with fiduciary duty, and disregarding ESG (environment, social and governance) factors in investment performance is actually a failure of fiduciary duty.

Impact and risk

Another argument foundation trustees often make against impact investments is that they are too risky. This belief is typically based on lack of familiarity with impact investing and an assumption that options are limited. T100 foundations know that’s not true.

‘As the impact investing space has continued to gain momentum, we recognize we are at a time when we have enough options to truly invest our portfolio for impact and financial growth simultaneously, without concession or undue incremental risk,’ said Jim Sorenson, founder of the Sorenson Impact Foundation.

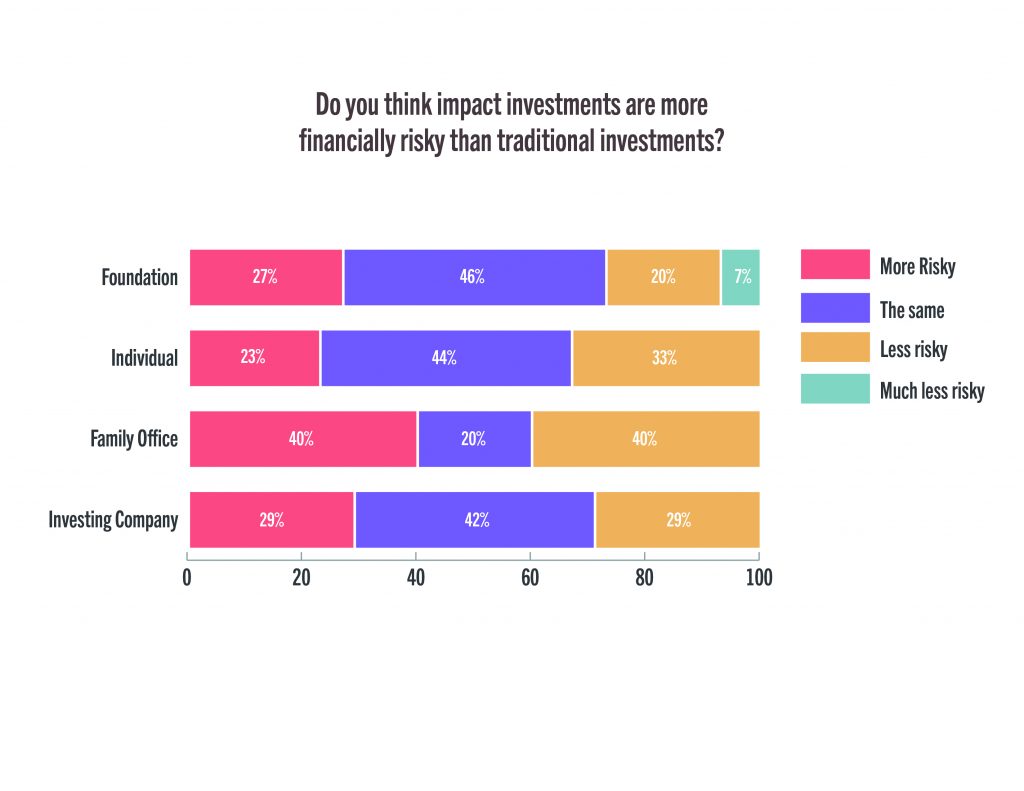

Only about a quarter of T100 participants considered impact investments to be more financially risky than traditional investments, while another quarter considered them to be either less or much less risky. Not only do impact investors see financially material ESG factors as mitigating risks, but they also believe that investing in positive impact is less risky than investing in the alternatives: continuing climate change, resource scarcity, and social instability.

The experience factor

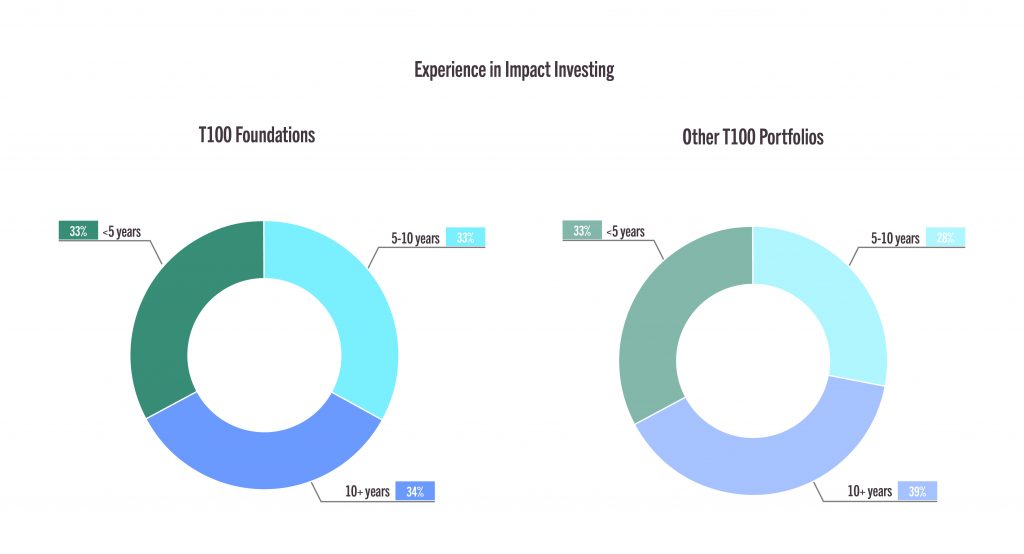

Finally, many foundation decision makers believe they must have previous impact investing experience. In reality, it’s possible to learn as you go. One-third of the foundations in the T100 study have less than five years of impact investing experience and another third have between five and 10 years.

Impact-investing foundations have help from investment professionals or chief financial officers who manage their assets. About half (54 per cent) of T100 foundations work with an advisor – some brought in a new advisor with impact expertise, while others asked an existing advisor to learn along with them.

‘I’ve gained confidence to be able to talk about money in a way that fits me and the way I solve problems, the way I think about philanthropy, and the way I think about really making change in the areas that need it,’ said Dr. Ruth Shaber, founder of Tara Health Foundation, after working with her advisors to build an impact portfolio that focuses on the health and well-being of women and girls.

Grantmaking alone will not solve the world’s problems – we need foundations to go all in on impact with their entire endowment. Yet these three misconceptions, as well as concerns about investment liquidity, staffing and resources, block progress. We urge foundations to read the full report and learn how foundations are embracing a whole-portfolio approach to positive net impact across the spectrum of capital.

Melody Jensen is the T100 Project Manager at Toniic.

Comments (0)