Donor Adviser Funds (DAFs) represent a growing proportion of philanthropic capital in the UK with £1.3 billion in UK charitable assets. They are an attractive alternative to setting up a charitable foundation which can be costly and time-consuming. More and more philanthropists are realising this, but fewer are aware that they can also be an attractive vehicle for making social impact investments.

Why make social impact investments from your DAF?

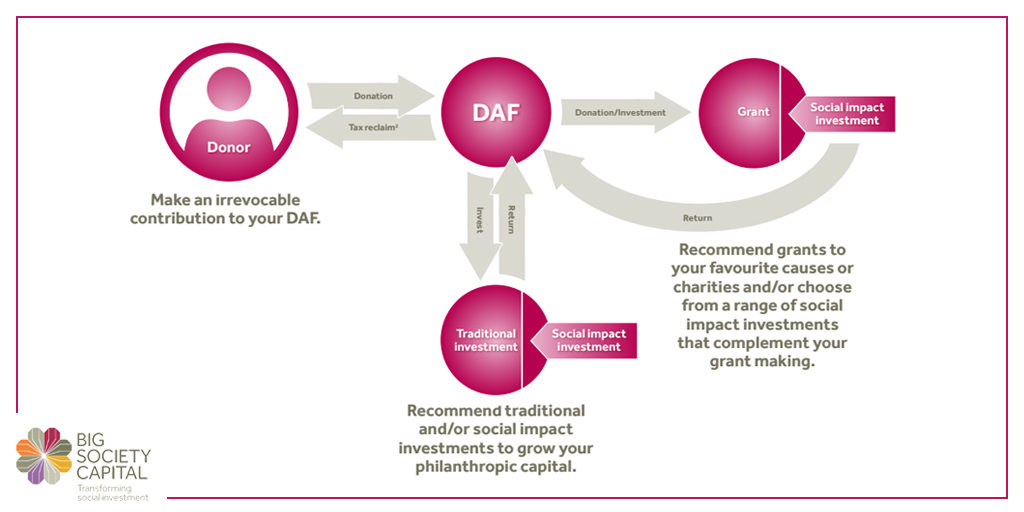

Once money is gifted to a DAF account, that gift is irrevocable having crossed the philanthropic boundary. This means: the donor has already decided that they want that money to go to good causes and; they have 100 percent capacity for loss on that contribution as it is no longer “legally” their money.

Yet surprisingly, most money held in DAFs is invested with little or no consideration at all for impact. Although traditional investments potentially offer better risk-adjusted returns, they don’t intentionally further the social objectives of the donor. In some cases, they may even be in direct conflict with their personal ethics or values.

If a donor chooses to make social impact investments, they can achieve a financial return whist staying true to their values and philanthropic objectives. This allows the impact to be compounded many times over by recycling an investment once it’s been repaid. And if the investment performs well, the amount eventually available for grants will have grown. Social impact investments are often perceived as higher risk, however, philanthropists are uniquely positioned to take this risk through their DAF.

It’s important to stress that social impact investing isn’t meant to replace grant capital, which will always be crucial for social purpose organisations with no repayable model. Social impact investing is most powerful when used in conjunction with grant to support organisations focused on delivering impact. As shared by Alexander Hoare in his interview for our guide, it’s part of a process of ‘trying to explore different ways to deploy philanthropic capital.’ Why aren’t more people doing it?

Why aren’t more people doing it?

1. Lack of awareness– we need to raise awareness of social impact investment, which has to-date been somewhat overshadowed by environmental impact investments. Raising awareness amongst donors holds the key, as professional advisers are not typically in a position to make recommendations to clients.

2. Scepticism of the role of investment- many donors believe grants are the best way to support social purpose organisations. This can be true, however, social entrepreneurs increasingly need larger sums of unrestricted money to scale and replicate what they do. Social impact investing combined with grants can play a powerful role in enabling this.

For example, CAF Venturesome provided the charity Best Beginnings (which aims to ensure every child has the best possible start in life) with a loan to support their operations. The loan bolstered the charity as it looked to diversify its revenue and become financially resilient by growing its trading income.

3. Availability of opportunities – sourcing and identifying investments represents one of the biggest barriers. One recommendation from a donor featured in our guide is to make social impact investments easier to find online and via social media.

To help raise awareness Big Society Capital has produced a guide for donors, Maximising your Philanthropy, which includes case studies featuring philanthropists who have had positive experiences making social impact investments through a DAF fund.

If more DAF capital is mobilised for social impact investment alongside donations we see the potential for huge positive social impact. If this is something you’re interested in learning more about please get in touch.

Katie Fulford-Smith is Engagement Manager at Big Society Capital

Comments (0)