It certainly is an exciting and interesting year for impact investing. The government is working to make the UK a global hub for social investment, a new tax relief has been announced and investment banks like Goldman Sachs and Morgan Stanley are entering the market. The most recent Impact Investor survey published by GIIN and JP Morgan also shows positive progress with market growth, investor collaboration, impact measurement practices, and pipeline quality.

But how do we know if investments are really creating a positive social impact? While the GIIN and JP Morgan report highlights promising progress I can’t help but wonder if impact investing is living up to expectations?

When it comes to measuring impact, the recent survey revealed that a quarter of all impact investors are indifferent to or prefer to avoid impact measurement post-investment. Great progress has been made in the last few years with many using impact standards and metrics like the Global Impact Investing Network standards or the BSC matrix. However, it seems that in practice fewer investors than we might expect measure these outcomes in a robust and systematic way. For many, merely stating that an organisation works to achieve outcome x or y is enough to show that impact is being achieved. Indeed, Clearly So and NPC’s investment readiness report found that most investors focus first and foremost on understanding the financial return of investments and social return comes as an afterthought. A 2013 LSE report concluded that the state of measurement was far from satisfactory. They found a lack of consensus over definitions and methodologies and, as a result, major differences between funds.

So, where does this leave us? Are we making well-meaning investments that look good but may not be changing anything for anyone? Research has shown us time and time again that great sounding things do not necessarily lead to positive impact or worse can do more harm than good. There is a growing realisation of the importance of measurement among investors but this needs to be backed up by impact measurement in practice.

Of course, this is easier said than done. Many investors (such as ourselves) back early stage ventures that are trying out new and innovative ways to tackle social problems. For these ventures, evidence will be hard to come by and the organisations are unlikely to have run a high quality impact evaluation. That is why it is essential to have a staged approach to impact measurement.

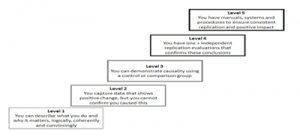

The NESTA Standards of Evidence for Impact Investing does exactly that. The standards on a 1-5 scale begin with organisations having a clear articulation of how their product or service leads to positive social change. As organisations grow and develop, we expect them to start gathering evidence to back up their initial understanding of their impact. Over time, we will work with organisations to understand whether that change was truly down to their activity, and finally, we hope to use this information to begin replicating the product in a number of different locations and contexts.

The five levels of NESTA’s Standards of Evidence for Impact Investing

For example, one of our investees, Oomph! delivers specially designed group exercise classes for older people in care homes to improve quality of life and physical health. Their impact story argues that interactive classes, specially designed for older people, are more successful in engaging residents. As a result, older people not only increase their level of enjoyment but over time improve their physical health and range of movement. Oomph! has used academic research to show that regular physical activity leads to improved life satisfaction, reduced cognitive decline and a reduction in falls. We are now working with them to gather evidence to see if this impact story rings true. So Oomph! is gathering data on the well-being and physical health of older people before and after exercise classes. This kind of data will allow them to reach level 2 on our standards of evidence. Over time, we will work with Oomph! to measure any difference between their participants and older people who did not attend the exercise classes. This way we will know if any change is purely down to the Oomph! classes.

Supporting our investees to start simple and increase the rigour of their evidence over time is crucial to our mission as an impact investor. Indeed, we will be judging our own impact as a fund on how well our investees do at delivering and evidencing impact as well as their financial success.

So, I would argue that as impact investors we need to worry most about what happens on the customer side of our investments. How many people is a venture working with? Who are they? And what kind of change are they seeing? Without asking these questions, we risk creating an elaborate house of cards—one that will begin to crumble if these fundamental questions remain unanswered and unmeasured.

Eibhlín Ní Ógáin, Insights manager at NESTA Impact Investments.

Comments (0)